Key Takeaways

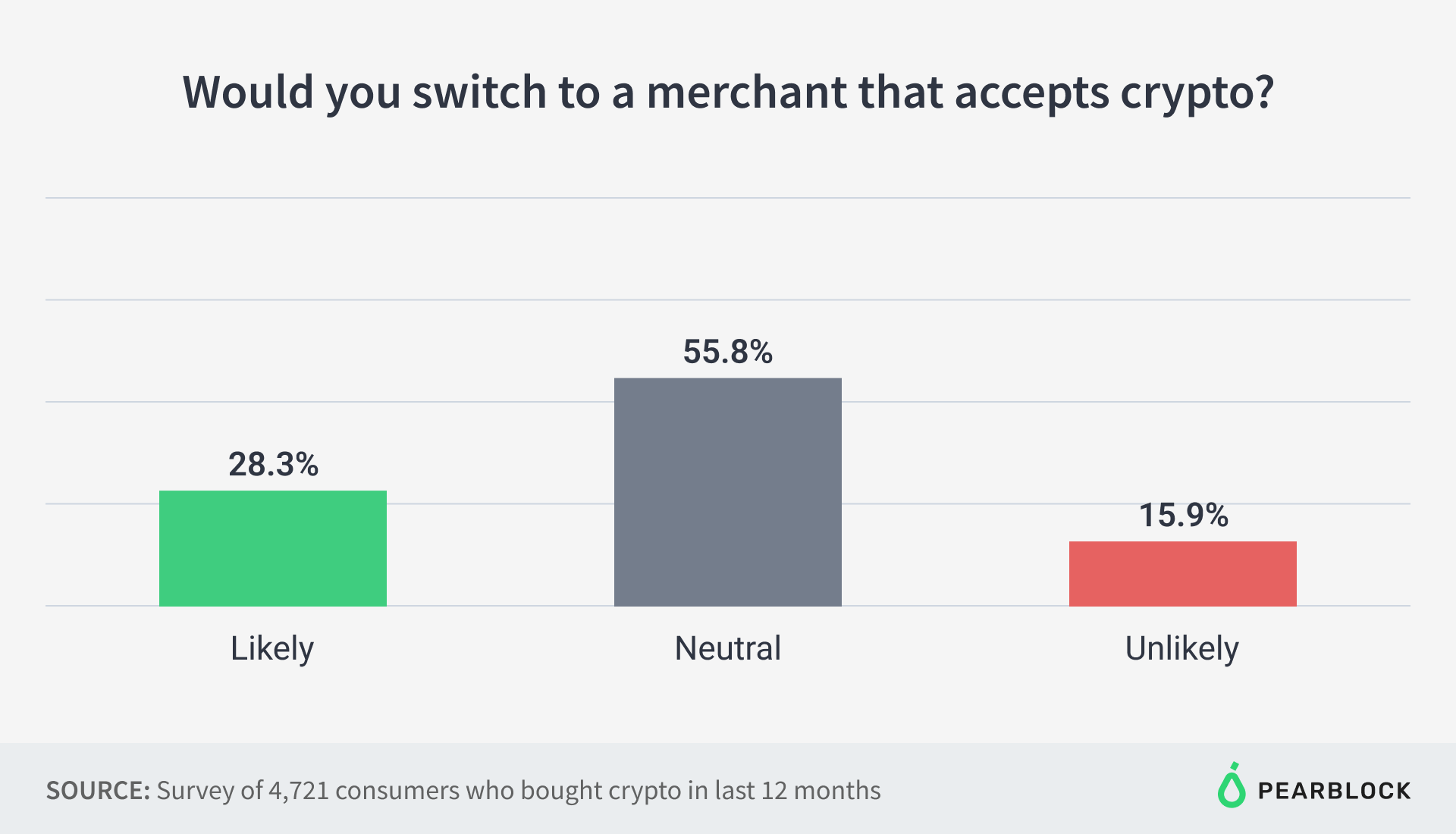

69.3% of crypto holders care if a merchant accepts their magic internet money. 28.3% would switch to a merchant that does.

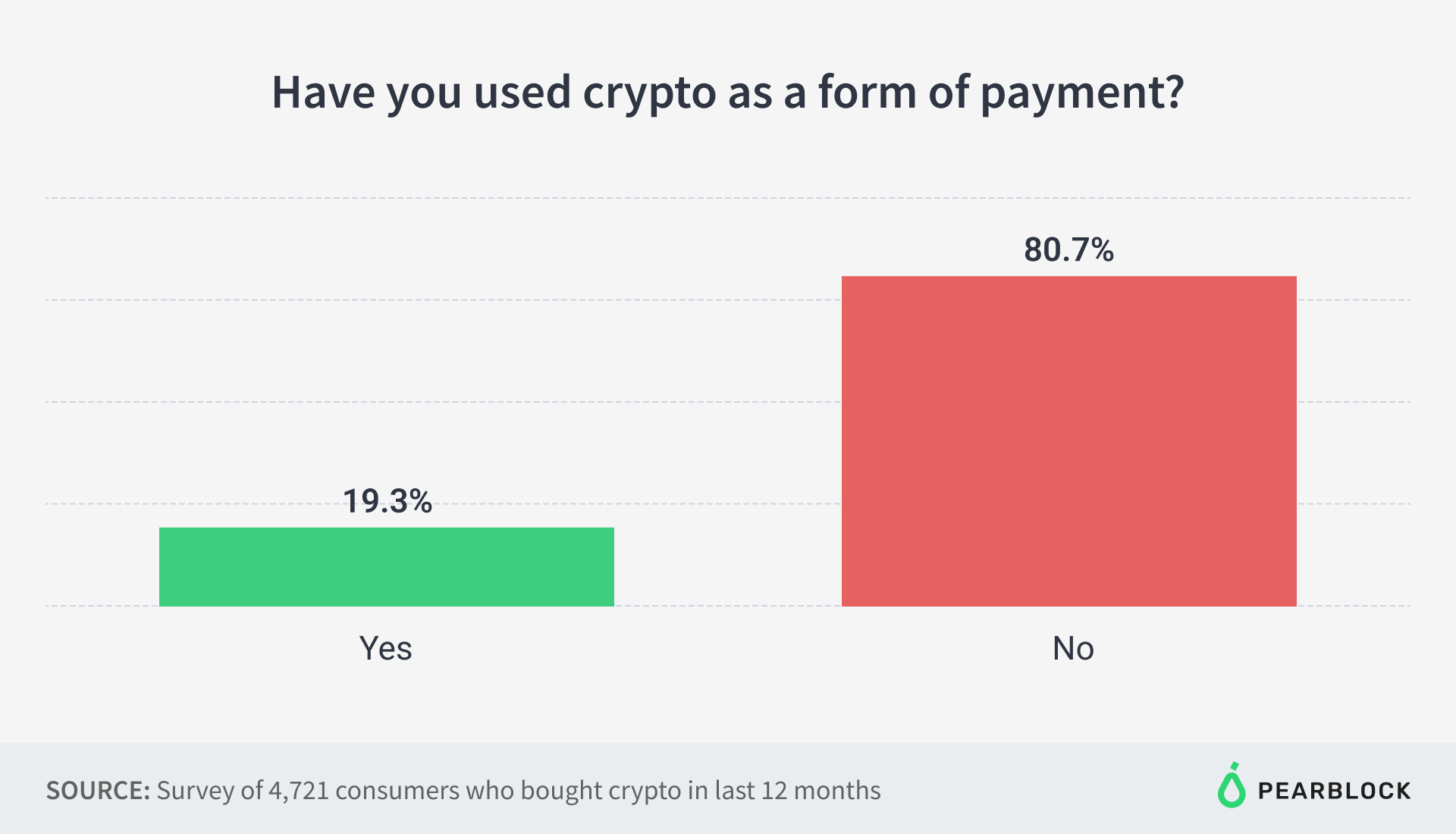

80.7% of consumers have not yet used crypto as a form of payment.

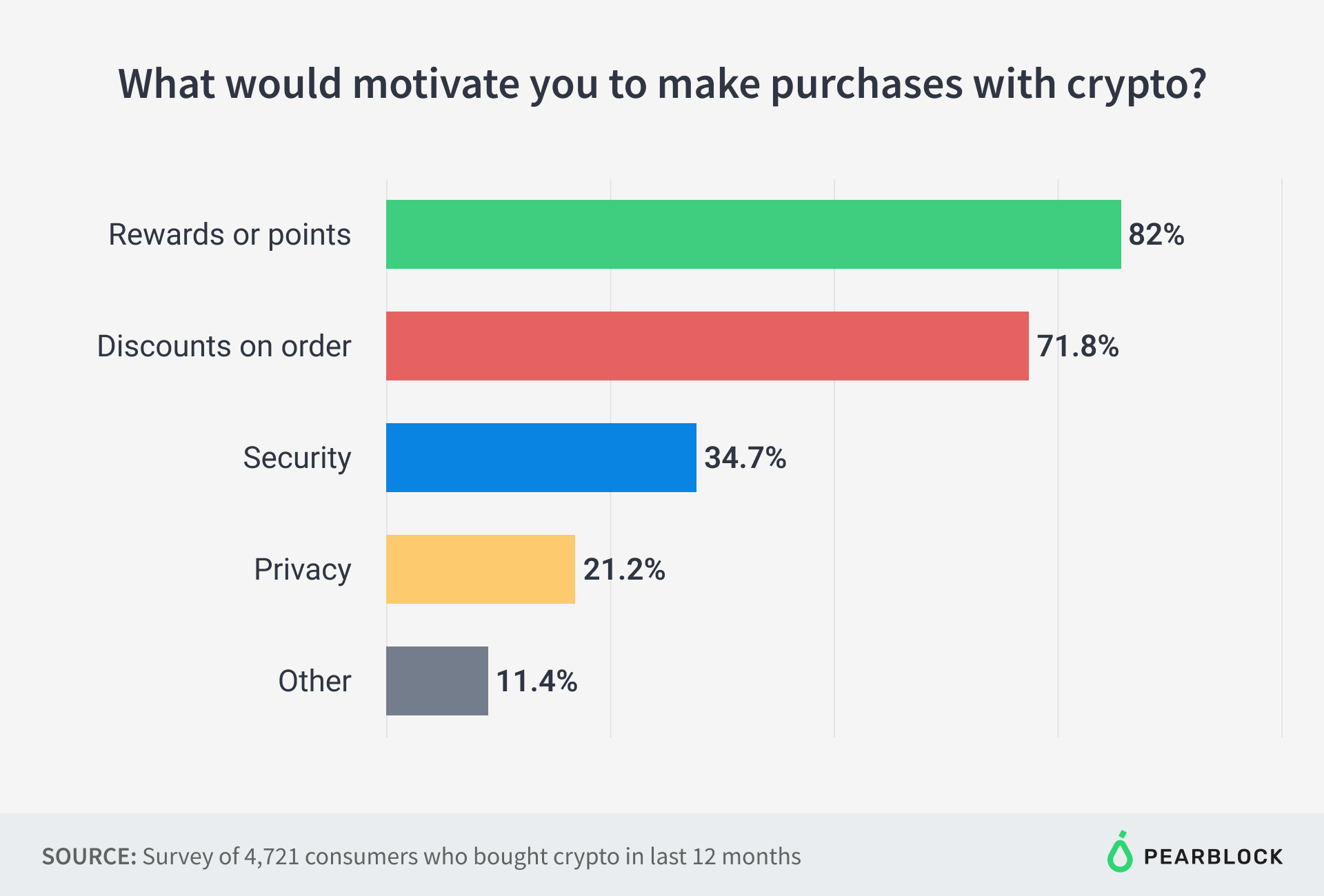

Discounts and rewards are the strongest motivators to use crypto instead of traditional payment methods.

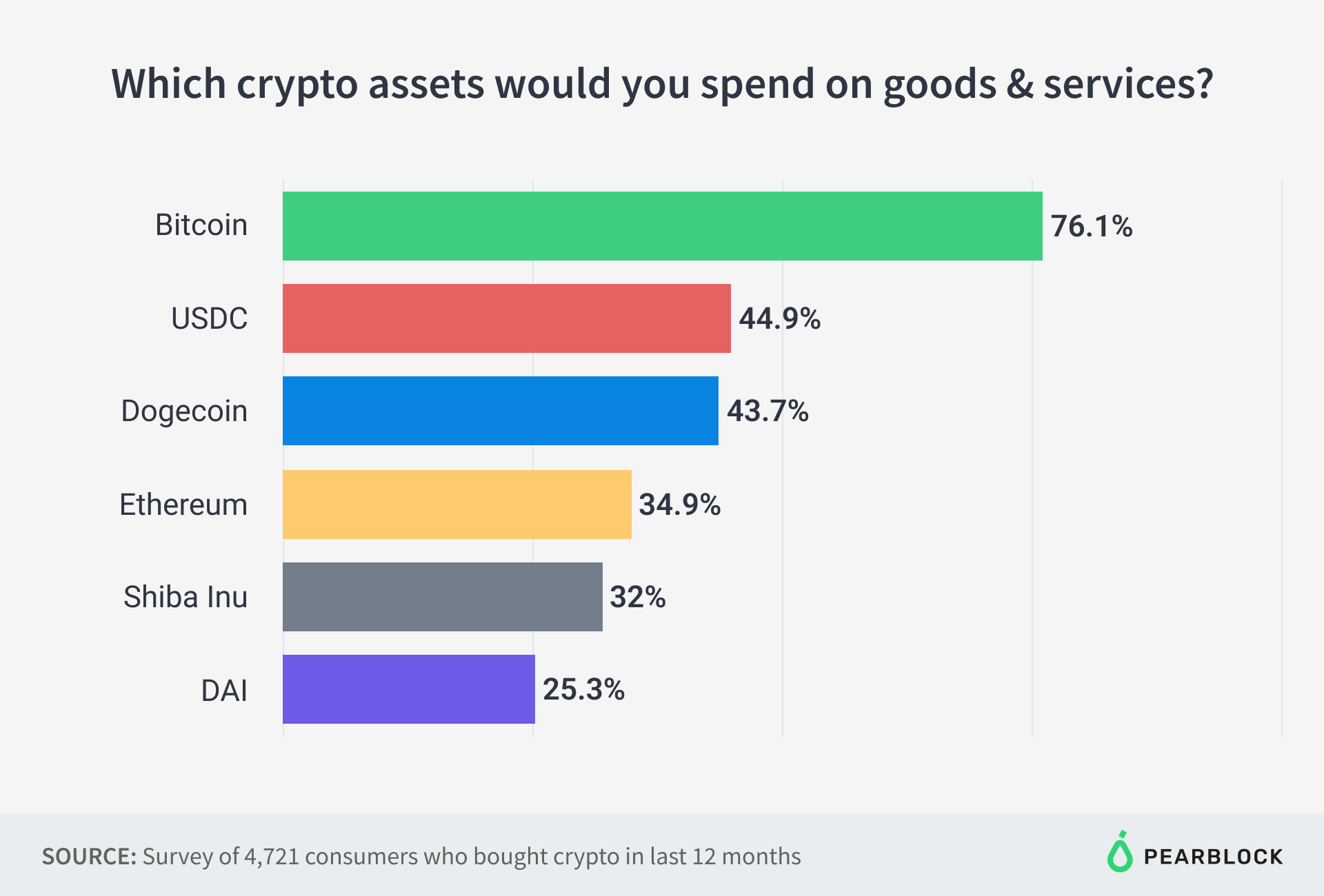

Consumers are more open to spend their DogeCoin than their ETH.

Introduction.

2022 has been eventful, to say the least.

The bear market shaved $2T off the total crypto market cap. Raging dumpster fires like Terra, 3AC, and FTX made us angrier than a T-rex with an itchy nose. The SEC is still asleep at the wheel with no regulatory framework in sight.

Yet, there is a real-world use case gaining adoption.

A growing number of merchants are willing to accept cryptocurrencies as a form of payment at checkout. Partly due to lower fees as compared to credit and debit card transactions. Party due to the desire to bring in new customers.

So we surveyed 4,721 consumers to understand their views and preferences on using crypto as a payment method.

Our data showed that consumers remain interested in giving digital money a try, but 80.7% have not pulled the gun yet. That signals an opportunity waiting to be unlocked. Apps like SPEDN, built upon the Flexa Network, already allow consumers to spend their crypto at retailers like Dunkin’ Donuts, Chipotle, and GameStop.

Current State of Crypto Holders.

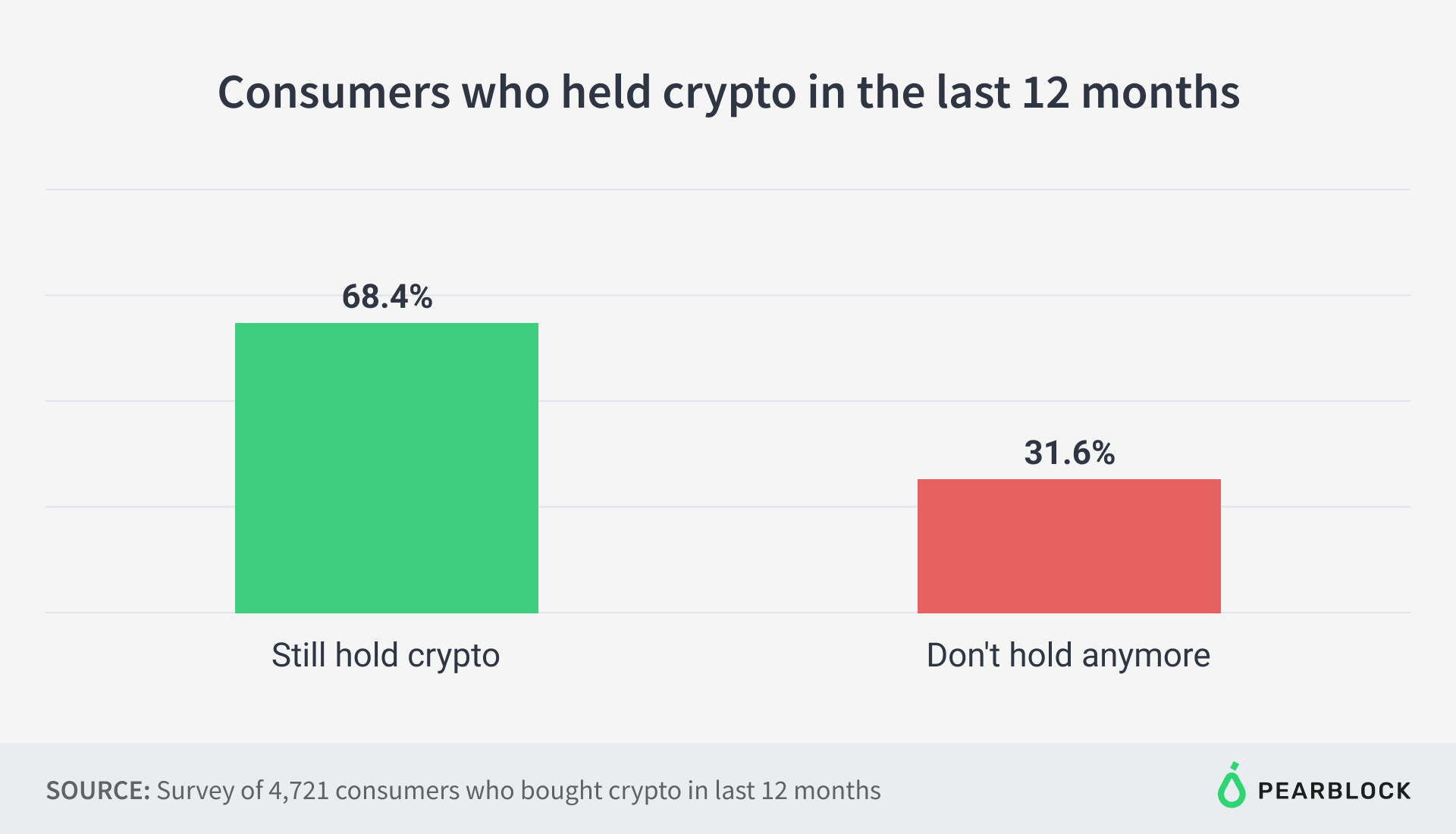

Whenever a prolonged downtrend has hit crypto in the past, social activity markers make it seem like a majority of people have exited the market. But data shows that only 31.6% have liquidated all their assets. 68.4% still have active exposure to crypto.

Opinion: while we don’t have consumer data on previous cycles, I feel that with each cycle there are more consumers opting to remain exposed to crypto.

Bitcoin Is Dead. Long Live Bitcoin.

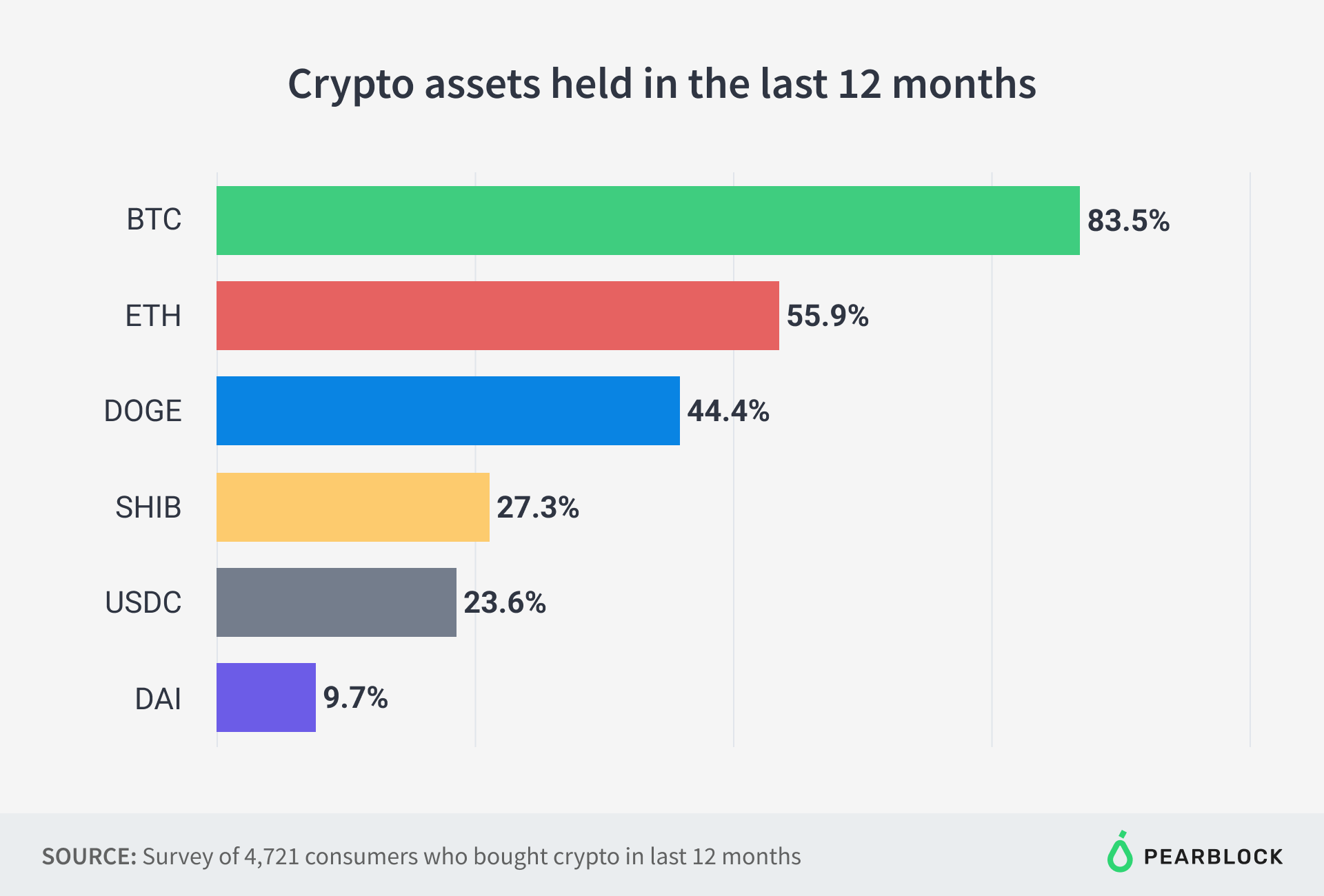

From DeFi to NFTs, Ethereum is arguably responsible for the largest growth in use cases. But good ol’ Bitcoin is still the godfather of assets that the majority of consumers hold. 83.5% reported having exposure to BTC as compared to only 55.9% holding ETH.

The Dogs of War.

Regardless of how institutional investors feel about meme dog coins, consumers are still bullish. Dogecoin and Shiba Inu gave mind-bending returns in the 2021 bull run, and many are betting the house on similar returns when the market trends higher. That is evident from the 44.4% of consumers that are long on DOGE.

In It for the Moolah, Not the Tech.

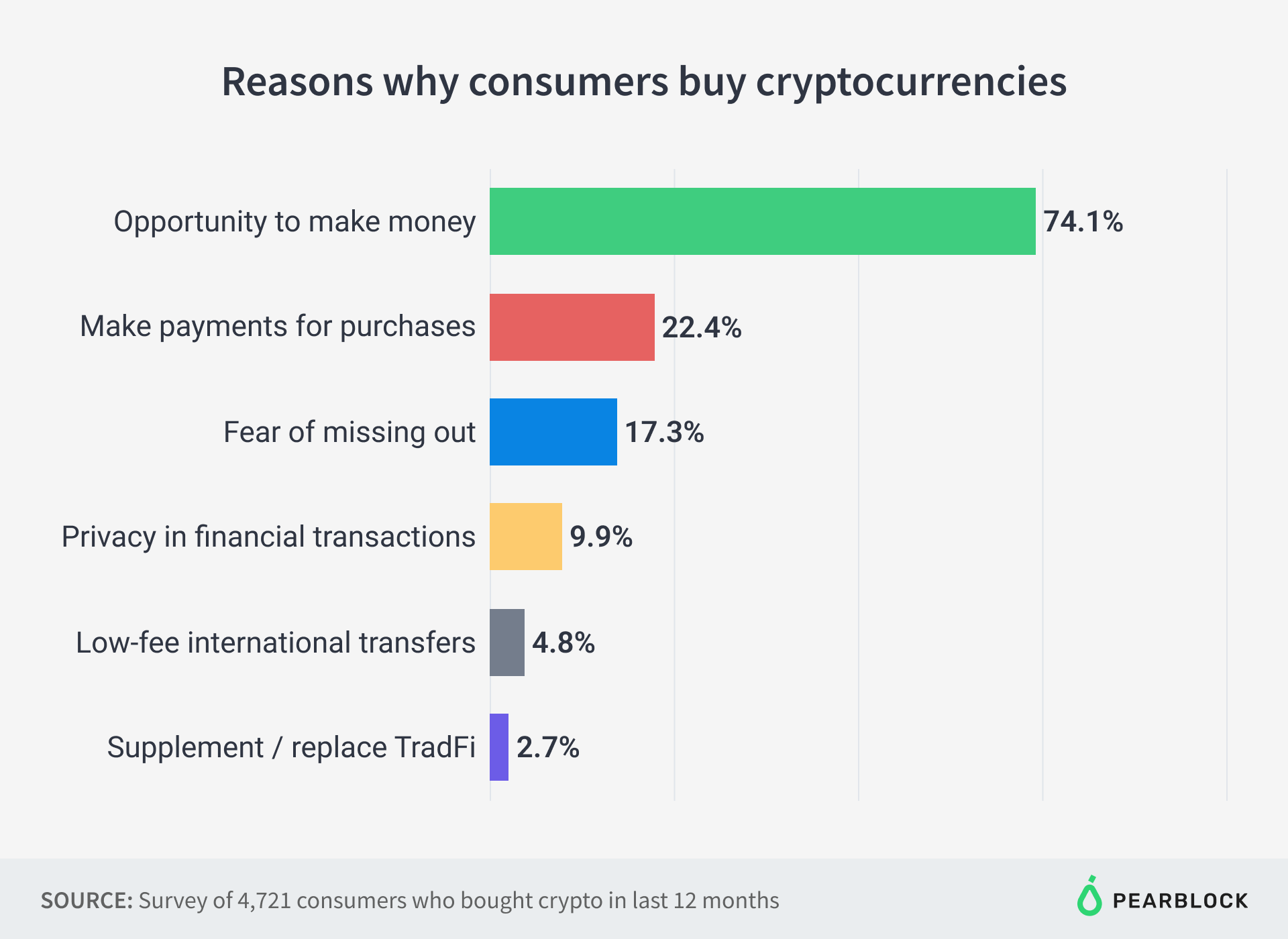

The majority of respondents expressed a desire to make money as their core motivation for buying crypto. That is not to say that real-world use cases weren’t on their minds. Being able to make payments and having privacy in financial transactions are the top use cases on the table.

If you live and breathe the CT bubble, many would cite traditional finance being enemy number one. But consumers couldn’t care less. Only 2.7% look at crypto being a replacement for TradFi.

Sorry, Michael Saylor, the majority aren’t buying Bitcoin to break the system's chains of financial oppression just yet.

Payments and Privacy: The Promised Land

Nearly 1 in 4 consumers are down to make payments with their crypto and 1 in 10 view the asset class as a way to get privacy. That’s a significant opportunity for the road ahead, albeit with regulatory potholes.

Opinion: privacy is a bigger uphill battle than payments. The powers that be have spent the last two decades desensitizing the population on breaching their privacy rights. Sanctions against Tornado Cash are a clear signal that the SEC is willing to hammer down any threat to the government’s ability to invade privacy.

Consumer Preferences in Crypto Payments

Bitcoin’s core premise was to be a means for people to send digital money. Satoshi intended to provide an alternative payment system that would operate free of centralized control.

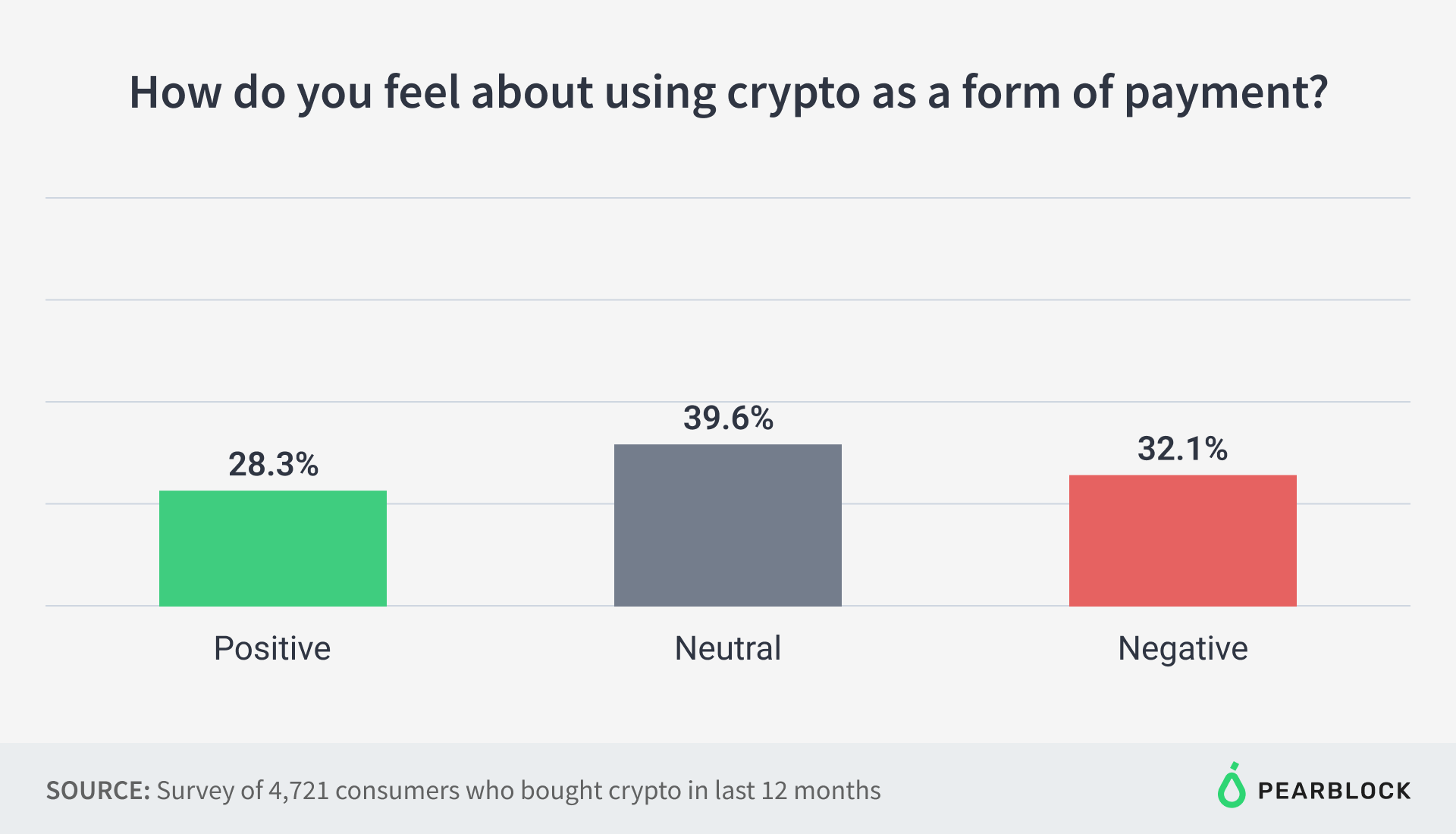

2 out of 3 consumers have either a positive or neutral stance on that vision, while 1 in 3 have a negative outlook on spending their magic internet money.

Seeing how most people have bought crypto to make gains, spending it would feel like a lost opportunity for some. Especially when spending non-stablecoin assets that could appreciate in a bull run.

Still Using Credit and Debit Cards

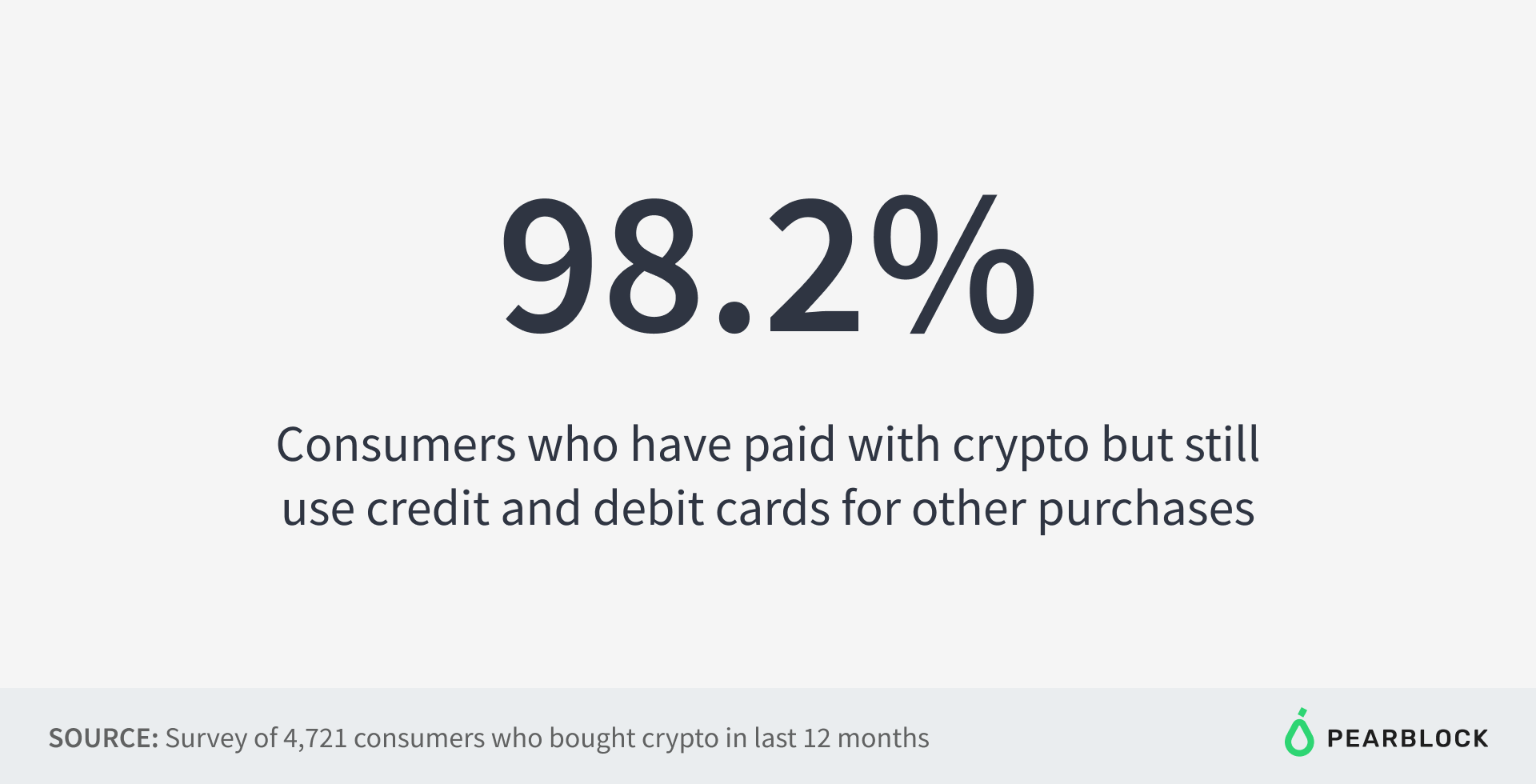

98.2% of people who have made purchases using crypto still use their credit and debit cards. While a growing number of merchants accept crypto, we aren’t even close to reaching widespread adoption as compared to credit cards.

Merchants face two key challenges: regulatory clarity and technical implementation. Even tech powerhouses like Amazon and Walmart have yet to take the plunge. All eyes are on Amazon, whose recent hires have led us to believe crypto payments are coming. When that will happen is yet to be seen.

While regulatory clarity is out of the industry’s hands and the task falls on the SEC, projects are tackling the technical implementation problem.

Flexa and AMP foundation have built a solution that requires no software or hardware changes for merchants. As of December 2022, Flexa allows merchants to accept payments in their customer’s choice of 99 digital currencies.

Gemini is going for a hybrid approach by offering a MasterCard where the cashback rewards are earnt in crypto.

Merchants Better Take Notice

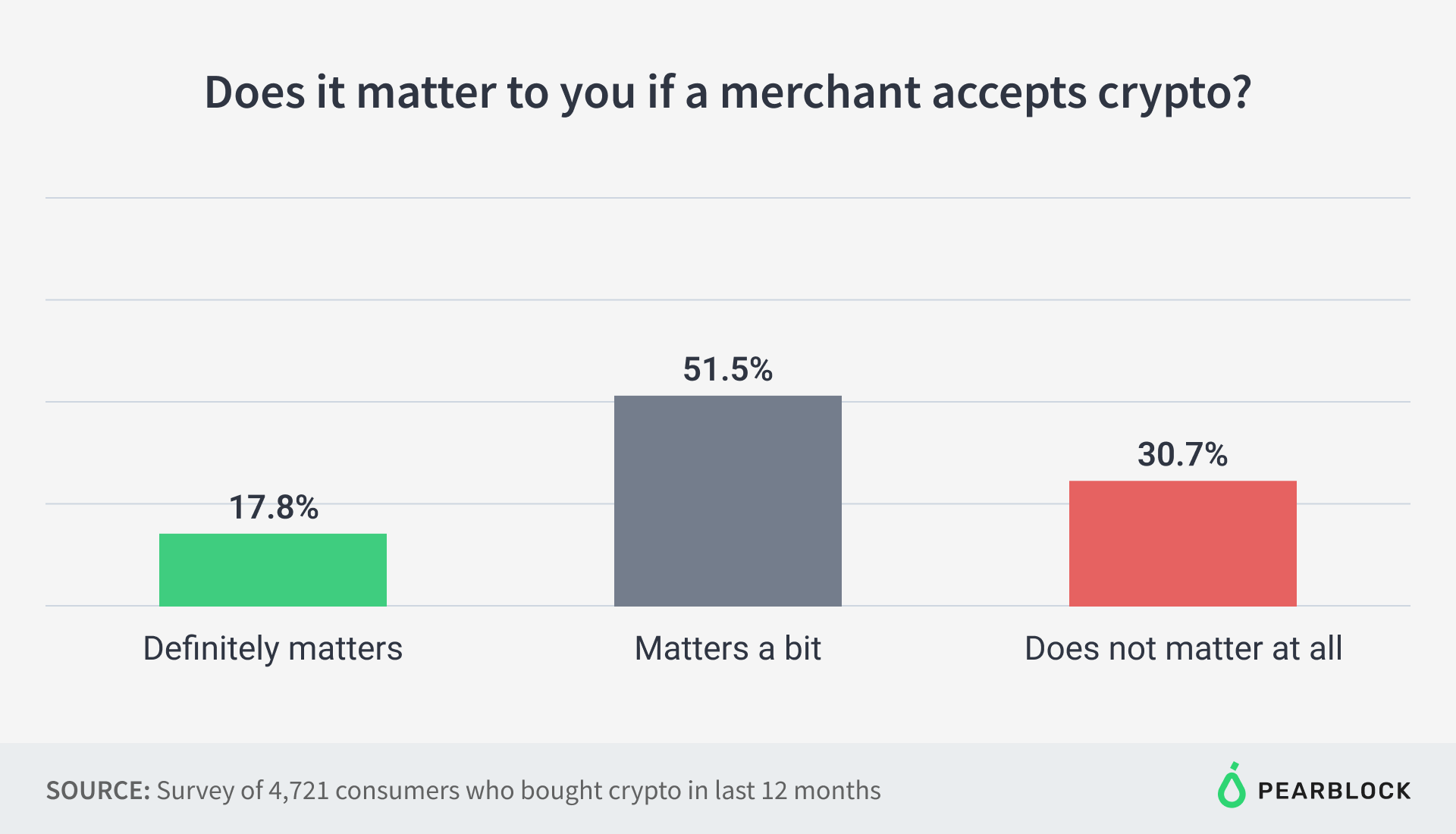

69.3% of crypto holders care if a merchant accepts their magic internet money. Acceptance of digital assets is fast becoming a competitive edge for merchants.

Even brands that don’t yet accept crypto are capitalizing on the trend to appeal to their target audience. Matell launched an NFT marketplace and Kellogg's slapped Sappy Seals on their cereal boxes.

New Customers Up for the Taking

If retailers needed a bright fluorescent green signal to start accepting crypto, here it is. 28.3% of holders are willing to switch to a merchant that accepts cryptocurrencies. With customer acquisition costs via digital ads continuing to rise, adopting crypto could be a low-hanging fruit.

Fewer Willing To Spend Their ETH

While Ethereum is the second most popular asset that consumers hold, only 34.9% are open to spending their ETH. People are more willing to spend their DogeCoin and USDC. The reason for this could be that people believe ETH has a greater opportunity for returns in the future. It could also be due to opportunities to use their ether in DeFi and NFTs.

Opinion: It was surprising to see that 76.1% would pay for things with their BTC. We would have assumed that stablecoins would lead the pack instead of a volatile asset that could appreciate in the future.

Consumers Want Rewards and Discounts

Credit card companies offer a lot to consumers: one-time bonuses, reward points, cash backs, and frequent-flyer miles. That presents a potential problem for crypto payments. The value proposition needs to match or beat what consumers are already getting to reach critical mass.

Most respondents stated that rewards and discounts would be the strongest motivators for them to chuck the credit card and open up a crypto payment app.

Methodology and Limitations

We surveyed 4,721 people who invest in cryptocurrencies using Prolific to explore user behaviors, preferences, and opinions. Respondents ranged in age from 18 to 52. The mean age was 29 with a standard deviation of 12 years. 67% of our respondents identified as men, 24% identified as women, and 9% preferred not to answer or identify as nonbinary.

This survey’s data relied on self-reporting, which is liable to certain limitations such as telescoping, exaggeration, and selective memory. We did not weigh our data or statistically test our hypotheses. Our margin of error was +/- 4% with a 95% confidence interval.

Fair Use Statement

We hope that you found these insights and data points helpful. You are free to share this data for any noncommercial purpose. We ask that you link back to this page when sharing with others or citing the data on another publication.

Pearblock team members hold the AMP token. We adhere to a strict ethical code of conduct and strive for unbiased journalism. Our mission is to report validated facts on crypto projects irrespective of personal investments. You can always view an updated list of all assets we hold.